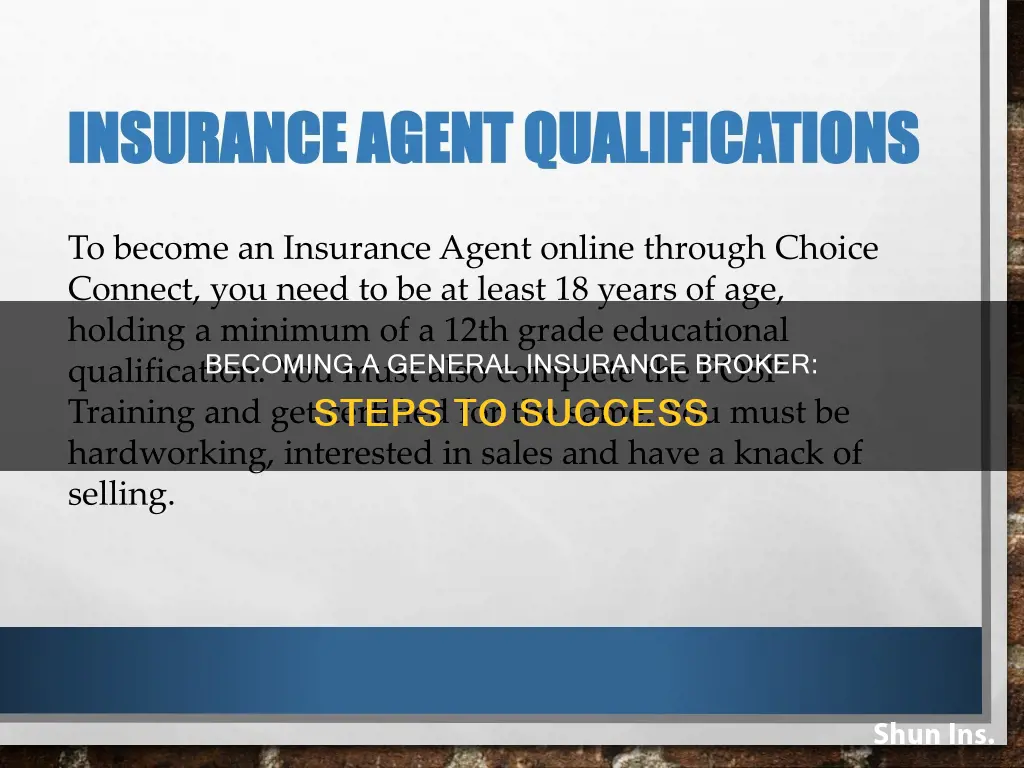

If you're interested in becoming a general insurance broker, you'll need to know the steps to take to be qualified for the role. The requirements vary depending on your location, but there are some general guidelines to follow. Here's an overview of the process to set you on the right path.

What You'll Learn

- Education: A college degree in insurance, business, economics, or finance is ideal

- Licensure: Check state-specific requirements, take a pre-licensing course, and pass the exam

- Specialties: Choose a type of insurance to focus on, such as property or auto insurance

- Experience: Consider internships or prior experience in insurance to enhance your application

- Skills: Develop communication, numeracy, and marketing skills to advise clients effectively

Education: A college degree in insurance, business, economics, or finance is ideal

While a college degree is not a requirement to become an insurance broker, it is ideal to have one in insurance, business, economics, or finance. A college degree can give you a strong background and skills to help you excel in your role. According to Zippia, 64% of brokers have a Bachelor's degree.

A postsecondary education, whether an associate degree, bachelor's degree, or another training program, gives you a solid background of knowledge, bolsters your resume, and may increase your employment opportunities. Common degree programs for insurance brokers include business administration and communications. Some educational institutions offer a degree specifically in insurance and risk management, but this degree isn't as common as the disciplines listed above. If you have the opportunity, an internship with an insurance firm is a great way to learn and apply your knowledge in a professional environment.

If you're looking to become an insurance broker in Ontario, you can pursue a degree or diploma in finance or economics. This can help you prepare for success and impress hiring managers.

Prepaid Insurance or Short-Term Debt: Navigating Liquidation Options

You may want to see also

Licensure: Check state-specific requirements, take a pre-licensing course, and pass the exam

To become a general insurance broker, you'll need to meet your state's specific licensure requirements. These requirements vary, so it's important to research the rules in your state. In general, you'll need to take a pre-licensing course and pass an exam.

In Texas, for example, you'll need to complete a prelicensing course approved by the Texas Department of Insurance. These courses are available online or in person and cover insurance fundamentals and various insurance specialties. After finishing the course, you'll receive a certificate of completion, which you'll need when applying for your license.

Once you've completed the necessary education, you can take the licensing exam. In Texas, the exam is provided by Pearson VUE and includes topics such as General Lines Life and Health, General Lines Property and Casualty, and Personal Lines Property and Casualty. The exam can be taken from home, with an off-site proctor observing via webcam and microphone.

After passing the exam, you'll typically need to pass a background check and apply for your license. In Texas, this involves visiting the Texas Department of Public Safety to provide fingerprints and answer questions about your criminal background. You can then submit your application, including your personal details, educational background, and certification from your pre-licensing course.

Underweight Insurance: What's the Cut-off?

You may want to see also

Specialties: Choose a type of insurance to focus on, such as property or auto insurance

When it comes to becoming a general insurance broker, choosing a specialty is an important step. This involves selecting a specific type of insurance to focus on, such as property, auto, health, or life insurance. This decision will guide your educational choices, internships, professional development, and licensure. Most states require different licenses for selling different types of insurance, so it is crucial to know the line of authority you want to pursue.

Property insurance is a type of insurance that provides coverage for people who own or rent a building. It covers areas such as damage and theft related to the property. If you choose to specialise in property insurance, you will be helping your clients protect their properties effectively and ensure they have the necessary coverage in case of any incidents.

On the other hand, auto insurance protects individuals from damages to their vehicles, covers expenses for passengers, and provides coverage for damages to other vehicles if the insured is at fault for an accident. As an auto insurance broker, you will be the go-to person for your clients when it comes to navigating the complex world of automotive insurance. You will help them understand the ins and outs of their policy, including exclusions and limits, and ensure they have the appropriate coverage for their needs.

Health insurance is another specialty option, which ensures individuals can receive medical care by covering the costs of their medical needs. As a health insurance broker, you will guide your clients in choosing the right health insurance plan for their specific circumstances. This may include understanding different policy options, such as coverage for specific medical conditions or routine check-ups.

Life insurance is a type of insurance where a company agrees to pay a set sum of money to a beneficiary when the policy owner passes away. Life insurance brokers help individuals plan for the future and ensure their loved ones are financially protected in the event of their death. This can include helping clients understand the different types of life insurance, such as term life insurance or permanent life insurance, and guiding them in making the best choice for their needs.

Each specialty has its own unique set of challenges and opportunities, so it is important to consider your interests and strengths when making a decision. By choosing a specialty that aligns with your passions and skills, you can provide valuable expertise to your clients and establish yourself as a trusted advisor in your chosen field.

Calendar-Year Insurance: What's Covered?

You may want to see also

Experience: Consider internships or prior experience in insurance to enhance your application

Gaining experience through internships or prior work experience is a great way to enhance your application and improve your chances of becoming a general insurance broker.

Internships are a fantastic way to learn about the insurance industry and gain practical skills and knowledge. Many internships offer real responsibility and exposure to the industry, allowing you to apply your knowledge in a professional environment. For example, Miller's paid internship scheme offers penultimate and final-year university students the opportunity to join their specialist teams and gain valuable experience.

If you're interested in an internship, consider reaching out to insurance firms or looking for opportunities advertised online. You could also try arranging an internship yourself if your educational program doesn't offer one. This can be a great way to get a foot in the door and make valuable connections in the industry.

Prior work experience in insurance can also be highly beneficial when applying to become a general insurance broker. This experience can provide you with valuable skills and knowledge that will make you a more competitive candidate. If you have worked in a related field, such as finance or economics, this could also strengthen your application.

When applying for internships or jobs in insurance, be sure to highlight any relevant experience or skills you have. For example, communication, mathematical, accounting, and marketing skills are all highly valued in the insurance industry.

Remember that gaining experience through internships or prior work is just one part of your application. Combining this with the appropriate education, exams, and licenses will give you the best chance of becoming a successful general insurance broker.

Contractor COI: Additional Insured Changes Normal?

You may want to see also

Skills: Develop communication, numeracy, and marketing skills to advise clients effectively

To become a successful general insurance broker, you must develop a set of skills that will enable you to advise your clients effectively. These skills include communication, numeracy, and marketing abilities.

Communication skills are essential for building strong relationships with clients and conveying information clearly and concisely. As an insurance broker, you should be able to explain complex insurance policies in a simple and easy-to-understand manner. Active listening is a key aspect of effective communication, allowing you to absorb client instructions, ask relevant questions, and ensure accurate understanding. Additionally, maintaining a professional tone in your interactions fosters a sense of respect and trust.

Numeracy skills are crucial for insurance brokers to analyse data, interpret mathematical information, and solve real-world problems. A solid grasp of basic mathematics, including addition, subtraction, division, and multiplication, is essential. Advanced numeracy skills, such as understanding trends, data analysis, and applying statistical concepts, enable brokers to make informed decisions and provide valuable advice to clients.

Marketing skills are also valuable for insurance brokers, especially in promoting insurance products and services. Understanding market trends, consumer behaviour, and competitor strategies helps brokers tailor their offerings effectively. Additionally, leveraging digital marketing techniques, such as search engine optimization (SEO) and social media marketing, enhances online visibility and attracts potential clients.

Developing these skills will enable you to excel as a general insurance broker, providing valuable advice and guidance to your clients as they navigate the complex world of insurance.

Maximizing Telehealth Nutrition Counseling Reimbursement: A Guide to Efficient Insurance Billing

You may want to see also