When you leave a job, it's important to consider the impact on your life insurance coverage. Many employers offer group life insurance as a benefit to their employees, and when you transition to a new role or stop working for your current company, this coverage may no longer be available. Understanding the terms of your existing policy and the options for maintaining coverage is crucial to ensure your financial security and the protection of your loved ones. This paragraph sets the stage for a discussion on the implications of job changes on life insurance benefits.

| Characteristics | Values |

|---|---|

| Employer-Provided Life Insurance | When you leave your job, you typically lose the employer-sponsored life insurance coverage. This type of insurance is often a benefit offered by the company as part of the employee's compensation package. |

| Term Life Insurance | Term life insurance, which provides coverage for a specific period (e.g., 10, 20, or 30 years), usually ends when the term is over. If you don't renew or switch to a new policy, the coverage will lapse. |

| Conversion Option | Some employer-provided life insurance policies may offer a conversion option, allowing you to convert your term life insurance into a permanent policy when you leave your job. However, this is not a standard practice and may require additional fees. |

| Individual Life Insurance | If you have an individual life insurance policy, it will continue to be valid regardless of your employment status. You can keep this policy and maintain coverage by paying the premiums. |

| COBRA Coverage | COBRA (Continuation of Coverage) allows you to keep your group health insurance, including life insurance, for a limited time after leaving your job. However, this is not applicable to life insurance specifically. |

| Renewal Options | Some individual life insurance policies offer renewal options, allowing you to extend coverage at the end of the term. This can be a way to maintain coverage even after leaving your job. |

| Group Term Life Insurance | Group term life insurance provided by employers often has a specific duration, and leaving the job means you won't be eligible for future renewals or new group plans. |

| Portability | Individual life insurance policies are generally more portable. You can take your policy with you and maintain coverage even if you change jobs or careers. |

| Cost Considerations | When you leave your job, you may also lose the lower-cost group life insurance rates associated with your employment. Individual policies might be more expensive, but they offer more flexibility. |

| Review and Planning | It's essential to review your life insurance coverage regularly, especially when changing jobs. Consider your financial needs and decide whether to maintain individual coverage or explore other options. |

What You'll Learn

- Term Life Insurance: Typically ends when employment contract is terminated

- Group Coverage: Often tied to employment, so it may lapse upon leaving

- Conversion Options: Some policies allow conversion to individual plans post-employment

- Grace Periods: Carriers may offer grace periods to continue coverage

- New Plans: You can explore individual life insurance options after leaving your job

Term Life Insurance: Typically ends when employment contract is terminated

When you leave your job, one of the important considerations is what happens to your life insurance coverage. Term life insurance, a popular choice for many employees, is directly tied to your employment contract. This type of insurance provides coverage for a specific period, often aligned with the duration of your employment. So, when your employment contract ends, the term life insurance policy typically expires as well.

The reason for this is straightforward: term life insurance is designed to offer financial protection during a specific period, usually while you are employed and earning an income. It serves as a safety net for your loved ones in the event of your untimely death during the policy term. When you no longer have an active employment contract, the need for this coverage may diminish, as your income and the associated financial responsibilities might change.

It's important to note that the decision to continue life insurance coverage after leaving a job is a personal one. Some individuals may choose to maintain their term life insurance, especially if they have financial dependents or significant financial obligations. In such cases, they might consider converting the term policy into a permanent life insurance plan, ensuring long-term coverage. However, this decision should be made after evaluating your current financial situation and future needs.

If you decide to keep your term life insurance, it's crucial to review your policy and understand the terms and conditions. Some insurance providers offer options to extend or convert the policy, allowing you to maintain coverage even after your employment ends. These options may include converting the term policy into a whole life insurance plan, which provides lifelong coverage, or extending the term for a specified period.

In summary, when you leave your job, your term life insurance policy will typically terminate unless you take proactive steps to continue or modify your coverage. It is essential to assess your financial situation and make informed decisions regarding your life insurance to ensure that your loved ones are protected, even after your employment contract has ended.

Understanding Ley Person Life Insurance: A Comprehensive Guide

You may want to see also

Group Coverage: Often tied to employment, so it may lapse upon leaving

When you leave your job, one of the immediate concerns you might have is what happens to your benefits, including life insurance. Group coverage, which is a common type of life insurance provided by employers, often comes with certain conditions and limitations. Understanding these can help you make informed decisions about your insurance coverage.

Group life insurance is typically offered as a benefit to employees, providing a level of financial security for their families in the event of their death. This type of coverage is usually more affordable compared to individual policies because the employer shares the risk with multiple employees. However, it's important to note that group insurance is often tied to your employment status. When you leave your job, the group coverage you had may not automatically continue.

The reason for this is that group life insurance policies are typically administered through the employer's payroll system. When you start a new job, you might need to re-enroll in a new group plan, or you may have the option to continue the existing coverage for a limited period, often referred to as a conversion privilege. This privilege allows you to convert your group coverage into an individual policy, ensuring that your life insurance doesn't lapse immediately. However, this option may come with additional costs and different terms and conditions.

Upon leaving your job, you should review your group insurance policy documents carefully. These documents will outline the terms of your coverage, including any provisions for continuing the policy after employment ends. Some employers may offer a grace period during which you can continue the coverage, but this is not standard practice. It's essential to take action promptly to ensure you don't lose the coverage you and your family depend on.

In summary, group life insurance coverage is often linked to your employment, so it's crucial to understand the terms of your policy. When you leave your job, you may need to take specific steps to continue your life insurance coverage, such as converting it to an individual policy or exploring other options provided by your previous employer. Being proactive in reviewing and managing your insurance benefits will help you maintain the financial protection you and your loved ones need.

Leaving Life Insurance to Animal Rescues: Is It Possible?

You may want to see also

Conversion Options: Some policies allow conversion to individual plans post-employment

When you leave your job, it's important to understand what happens to your life insurance coverage. Many employers offer group life insurance as a benefit to their employees, and this coverage often ends when you no longer work for the company. However, there is a valuable option to consider: the ability to convert your group life insurance into an individual plan.

Conversion options are a crucial aspect of maintaining your life insurance coverage after leaving employment. Some insurance providers offer this feature, allowing you to continue your life insurance policy as an individual plan. This means that even though your group coverage ends, you can still have personal protection for yourself and your loved ones.

The process of converting your policy typically involves contacting your insurance provider and expressing your interest in the conversion option. They will guide you through the necessary steps, which may include filling out forms and providing updated personal and health information. It's essential to review the terms and conditions of the conversion process to ensure you understand any potential changes or limitations.

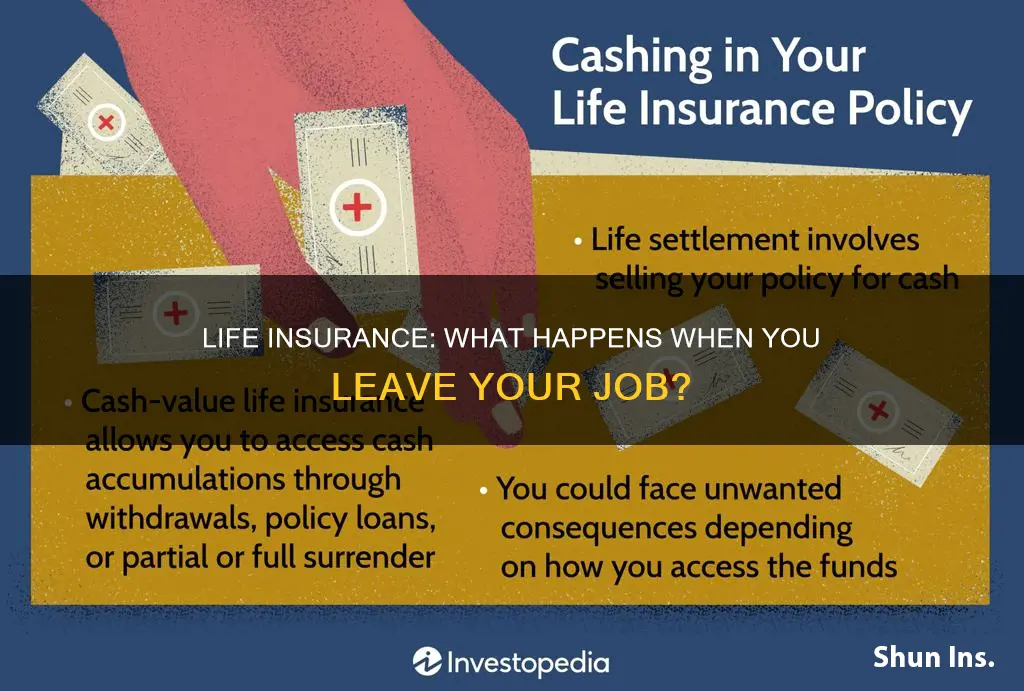

By opting for conversion, you gain the flexibility to choose a new plan that suits your current needs and budget. Individual life insurance policies can offer various coverage options, allowing you to customize the protection according to your preferences. This is particularly beneficial if you have specific financial goals or want to ensure long-term coverage for your family.

When considering conversion, it's advisable to compare different insurance providers and their offerings. Some companies may provide more favorable terms or additional benefits during the conversion process. Additionally, reviewing your financial situation and understanding your current insurance needs will help you make an informed decision. Remember, taking advantage of conversion options can provide peace of mind, ensuring that your life insurance coverage continues even after your employment changes.

Canceling Medibank Life Insurance: A Step-by-Step Guide to Termination

You may want to see also

Grace Periods: Carriers may offer grace periods to continue coverage

When you change jobs, it's important to understand the implications for your life insurance coverage. Typically, when you leave a job, you may lose your employer-sponsored life insurance benefits, as these policies are often tied to your employment status. However, there is a crucial aspect to consider: grace periods. These grace periods are a safety net provided by insurance carriers to ensure that you don't lose your coverage abruptly.

Grace periods are a temporary extension of your life insurance coverage, allowing you to maintain your policy for a specific duration after leaving your job. During this period, you can continue to pay the premiums, and the insurance company will continue to provide the coverage. The length of the grace period varies depending on the insurance provider and the terms of your policy. It can range from a few days to several months, providing you with time to make alternative arrangements for your life insurance.

The primary purpose of these grace periods is to prevent individuals from facing a gap in their life insurance coverage, which could be financially devastating during a time of transition. It gives you the opportunity to explore other options, such as purchasing a new individual life insurance policy or converting your existing coverage into a personal plan. During this grace period, you can carefully assess your insurance needs and make informed decisions about your future coverage.

To take advantage of a grace period, you'll need to notify your insurance carrier about your job change and provide the necessary documentation. They will guide you through the process and inform you of the specific requirements and procedures. It's essential to act promptly during this period to ensure you don't inadvertently lose your coverage.

In summary, grace periods are a valuable feature of life insurance policies, offering a temporary solution when you leave a job. They provide a safety net, allowing you to maintain coverage and make informed decisions about your future insurance needs. Understanding and utilizing these grace periods can help ensure that you continue to have the financial protection you and your loved ones deserve, even during periods of job transition.

Northwestern Mutual: Suicide Coverage in Life Insurance Policies

You may want to see also

New Plans: You can explore individual life insurance options after leaving your job

When you leave your job, it's important to consider the future of your life insurance coverage. Many employees are surprised to learn that group life insurance provided by their employer may not transfer to a new job or continue indefinitely. This is a critical aspect of financial planning that should not be overlooked.

After leaving your employment, you have the opportunity to explore individual life insurance options tailored to your specific needs. This is a great time to reassess your coverage and ensure that you and your loved ones are protected financially. Individual life insurance policies offer a level of customization that group plans might not provide, allowing you to choose the coverage amount, term length, and other features that align with your personal circumstances.

The process of transitioning to individual life insurance is straightforward. You can start by researching different insurance providers and comparing their offerings. Many companies now offer online platforms where you can request quotes, compare policies, and even apply for coverage without the need for a medical examination. This makes it convenient to explore your options and make an informed decision.

When considering individual life insurance, it's essential to understand the various types of policies available. Term life insurance provides coverage for a specified period, offering a cost-effective solution for a defined duration. On the other hand, permanent life insurance, such as whole life or universal life, offers lifelong coverage and includes a savings component, allowing you to build a cash value over time.

By taking the initiative to explore individual life insurance options, you gain control over your financial security. This is especially crucial if you have dependents or financial commitments that rely on your income. Leaving your job doesn't mean you have to lose the protection you've built; instead, it presents an opportunity to make informed choices and ensure a brighter, more secure future for yourself and your loved ones.

Life Insurance Agents: Fiduciary Duty or Not?

You may want to see also

Frequently asked questions

Typically, when you leave a job, your employer-provided life insurance policy will also end. This is because group life insurance policies are often tied to your employment status. However, it's important to review your policy documents or contact your insurance provider to understand the specific terms and conditions. They might offer options to continue the coverage, such as converting it to an individual policy or exploring other group plans with your new employer.

Yes, if you voluntarily leave your job, you generally have the option to continue your life insurance coverage. Many insurance companies allow you to port your policy to a new group plan or even offer individual coverage. It's advisable to contact your current insurance provider to discuss the process and any potential costs associated with maintaining the policy after leaving your job.

In the event of a layoff, your life insurance coverage might continue for a specified period, often referred to as a "conversion period" or "grace period." During this time, you can decide whether to keep the policy, convert it to an individual plan, or allow it to lapse. It's crucial to act promptly during this period to ensure your coverage remains in place or to make the necessary arrangements for your insurance needs.