Josh Powell's family is in the spotlight following the tragic death of Susan, his wife, as they seek to understand the circumstances surrounding her passing. The focus has shifted to the substantial life insurance policy she held, which has sparked curiosity and speculation among the public. With the insurance company's involvement and the ongoing investigation, the family's quest for answers and justice has become a central point of interest, leaving many to wonder about the true nature of Susan's death and the role of the insurance money in this complex case.

What You'll Learn

- The Insurance Policy: Susan's life insurance payout and its terms

- Family Dynamics: How the insurance money affected family relationships

- Legal Battle: The legal process and disputes over the insurance claim

- Financial Impact: Changes in the family's financial situation post-insurance

- Emotional Struggles: The emotional aftermath and family coping mechanisms

The Insurance Policy: Susan's life insurance payout and its terms

The insurance policy in question is a life insurance contract taken out by Susan, the deceased, with a beneficiary named Josh Powell. The policy was likely a term life insurance, which provides a lump-sum payment to the beneficiary upon the insured's death. The payout amount and terms would have been specified in the policy document, which is a legally binding contract between the insurance company and the insured.

The key terms of the policy include the death benefit, which is the amount of money paid out to the beneficiary upon the insured's death. In this case, the death benefit is likely to be a significant sum, as it is intended to provide financial security for the beneficiary, especially if Susan was the primary breadwinner or had a substantial income. The policy may also include provisions for premium payments, the duration of the policy, and any exclusions or limitations on coverage.

The terms of the policy are crucial in determining the rightful recipient of the payout. Since Josh Powell is named as the beneficiary, he is the individual entitled to receive the death benefit according to the insurance company's records. However, the policy may also specify conditions under which the payout can be made, such as providing proof of death or satisfying any outstanding loan or mortgage payments on the insured's behalf.

It is essential to review the policy documents carefully to understand the specific terms and conditions. These documents outline the rights and obligations of both the insurance company and the beneficiary. They may also include provisions for disputes or disagreements, which could arise if there are multiple beneficiaries or if the beneficiary's identity is in question.

In summary, the insurance policy is a critical document that defines the terms of Susan's life insurance payout. The policy's terms, including the death benefit and any associated conditions, will determine how the payout is distributed to the beneficiary, in this case, Josh Powell. Understanding these terms is essential to ensure a smooth and fair process for all involved parties.

Protecting Your New Family: Life Insurance for New Parents

You may want to see also

Family Dynamics: How the insurance money affected family relationships

The story of Josh Powell and his family's pursuit of Susan's life insurance money is a complex and tragic tale that highlights the intricate dynamics within families when significant financial resources are at stake. The insurance payout, a substantial amount, became a catalyst for a series of events that revealed the fragility of relationships and the lengths to which individuals might go to secure their future.

As the investigation into Susan's death progressed, the Powell family's behavior became a subject of scrutiny. Josh, the husband, was initially presented as a grieving widower, but as the insurance money came into play, his actions raised suspicions. The family's financial situation was reportedly dire, and the insurance payout could have provided a much-needed financial cushion. However, the desire for this money seemed to drive a wedge between family members.

The dynamics between Josh and his father, Steve, took a turn. Steve, a former military man, had always been a pillar of strength and stability in the family. But when Josh's actions regarding the insurance money were questioned, Steve found himself in a difficult position. He had to choose between supporting his son or maintaining his own integrity. The once-close relationship between father and son became strained, with Steve taking a more distant approach, perhaps to protect himself from the fallout.

The impact on the rest of the family, including the children, cannot be understated. The insurance money became a source of tension and conflict, with each family member potentially having their own agenda. The children, who were already dealing with the loss of their mother, had to navigate the complex emotions of jealousy, anger, and betrayal. The once-cohesive family unit began to fracture, with members turning on each other, each seeking to secure their own interests.

In the end, the pursuit of Susan's life insurance money revealed a darker side to family relationships. It exposed the lengths to which individuals might go to ensure their financial security, even if it meant exploiting the grief and vulnerability of others. The Powell family's story serves as a cautionary tale, reminding us that financial gain can sometimes outshine familial bonds, and that the pursuit of money can lead to a breakdown of trust and harmony within a family.

Whole Life Insurance: A Child's Smart Investment Strategy?

You may want to see also

Legal Battle: The legal process and disputes over the insurance claim

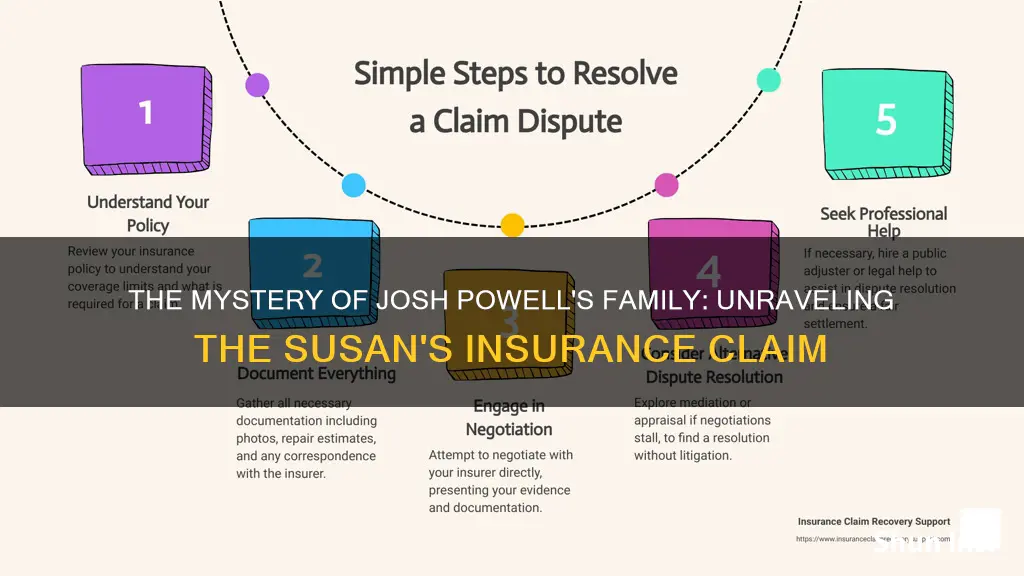

The case of Josh Powell and his family's pursuit of Susan's life insurance money has been a subject of intense legal scrutiny and public interest. The legal battle surrounding this matter has unfolded in a series of complex steps, with various legal arguments and disputes at its core. At the heart of this case is the question of whether Josh Powell, Susan's husband, was entitled to the proceeds of her life insurance policy.

The legal process began with the filing of a lawsuit by Josh's family, who claimed that Susan had fraudulently obtained the insurance policy and that Josh was a victim of her deceit. They argued that Susan had misrepresented her financial situation and that the insurance company should be held liable for the policy's proceeds. The insurance company, however, took a different stance, defending their decision to honor the policy as per the terms and conditions. They argued that the policy was validly issued and that Susan had the right to name her beneficiaries, including her husband, Josh.

The dispute escalated as both parties presented their cases before a judge. Josh's family presented evidence of Susan's alleged fraud, including financial records and witness testimonies. They argued that Susan had a history of financial misconduct and that she had intentionally misled the insurance company. The insurance company, on the other hand, provided documentation proving the policy's validity and the due process followed during the underwriting process. They emphasized the importance of adhering to legal procedures and the finality of insurance contracts.

The legal battle then shifted to the interpretation of the insurance policy's terms. The key issue was whether Josh was a valid beneficiary and whether Susan's actions voided the policy. The court had to carefully examine the policy's language, including any clauses related to fraud and beneficiary designation. This analysis became a critical point of contention, with both sides presenting legal experts to support their interpretations.

As the case progressed, the judge had to make a decision that would impact the lives of Josh and his family. The court's ruling would determine whether Josh Powell's family would receive the life insurance money, and it would set a precedent for similar cases. The legal process, in this instance, became a complex web of financial, ethical, and legal considerations, leaving a lasting impact on the involved parties and the insurance industry.

Life Insurance and Drug Testing: Guardian's Policy Explained

You may want to see also

Financial Impact: Changes in the family's financial situation post-insurance

The story of Josh Powell and his family's quest for Susan's life insurance money is a complex and tragic case that has garnered significant public interest. The financial implications of this scenario are multifaceted and can have a profound impact on the family's financial landscape. Here's an analysis of how the family's financial situation might have changed:

The primary financial impact would be the acquisition of a substantial sum of money through the life insurance policy. Susan's insurance payout could have provided a significant financial cushion for Josh and his children. This sudden influx of funds might have altered the family's financial stability and opened up new opportunities. For instance, the family could have used the money to pay off debts, invest in assets, or simply build an emergency fund, ensuring a more secure financial future. This financial windfall could have been a turning point, allowing the family to make long-term financial plans and potentially improve their overall financial health.

However, the story also hints at potential challenges. The family's financial situation might have become more complex if the insurance money was not managed wisely. Unscrupulous individuals or family members might have been tempted to exploit the situation, leading to financial disputes or legal battles. The pressure to make quick financial decisions could have resulted in poor investments or impulsive spending, potentially depleting the funds over time. It is crucial for families in such situations to have a clear financial strategy and professional guidance to navigate these challenges effectively.

In the aftermath of Susan's death, the family's financial priorities might have shifted. They may have had to adapt to a new reality, making financial decisions that honor Susan's memory while also securing their future. This could include creating a trust fund for the children's education or establishing a legacy in Susan's name that supports a cause she cared about. Such actions can provide a sense of closure and ensure that the insurance money is utilized in a meaningful way.

Furthermore, the family's financial journey post-insurance could be a learning curve. It might encourage them to develop better financial literacy and management skills. They could educate themselves about insurance policies, estate planning, and investment strategies to make informed decisions. This newfound financial awareness could empower the family to take control of their financial destiny and make prudent choices moving forward.

In summary, the financial impact of receiving Susan's life insurance money could have been transformative for Josh Powell's family. While it presented opportunities for financial security and growth, it also carried risks that required careful navigation. The family's ability to adapt, make wise financial decisions, and honor Susan's memory in their financial endeavors would be crucial in shaping a positive outcome from this tragic event.

Life Insurance Payouts: Medicaid Eligibility Impact Explained

You may want to see also

Emotional Struggles: The emotional aftermath and family coping mechanisms

The discovery of Susan's life insurance money and the subsequent legal battle over its distribution has undoubtedly left an indelible mark on the Powell family. The emotional aftermath of such a significant financial dispute can be overwhelming and complex. For the family, the process of navigating this challenging situation may have triggered a range of emotions, including grief, anger, resentment, and a sense of betrayal. The loss of Susan, a family pillar, is a profound and traumatic experience, and the added layer of financial conflict can exacerbate these feelings.

One of the primary emotional struggles is the sense of loss and grief. The family is likely grappling with the absence of Susan, which can lead to feelings of loneliness, sadness, and a deep void. The insurance money, intended to provide financial security, has now become a source of contention, potentially overshadowing the emotional healing process. The family may feel torn between their love for Susan and their desire to protect their financial interests, creating a complex web of emotions.

Anger and resentment are common emotions that may arise during this period. The family might direct their anger towards the person or entity responsible for the dispute, or even towards each other if the situation has caused internal divisions. Resentment could stem from the perceived injustice of the situation, especially if the family feels their rights and expectations have been violated. This negative emotional state can strain relationships and create a hostile environment, making it challenging for the family to move forward together.

Coping mechanisms are essential for the family to navigate these emotional struggles. Open and honest communication is vital. Each family member should be encouraged to express their feelings and concerns without fear of judgment. Holding regular family meetings or individual counseling sessions can provide a safe space for processing emotions and working through the challenges. It is crucial to address the underlying issues causing the dispute and find a resolution that respects the family's values and traditions.

Additionally, seeking external support can be beneficial. Engaging a neutral third-party mediator or legal advisor can help facilitate a fair and respectful resolution. This professional guidance can provide an objective perspective and assist in finding a compromise that satisfies all parties involved. Furthermore, reaching out to support groups or seeking counseling services can offer the family a sense of community and emotional support during this difficult time.

In summary, the emotional aftermath of Susan's life insurance money dispute is likely to be a challenging journey for the Powell family. By recognizing and addressing their emotions, fostering open communication, and seeking appropriate support, they can begin to heal and move towards a resolution that allows them to honor Susan's memory and secure their future.

Life Insurance: NRMA's Offerings and Your Options

You may want to see also

Frequently asked questions

The investigation was sparked by the sudden and mysterious death of Susan Powell, who disappeared from her home in Utah in 2009. Josh, her husband, initially claimed that she had left without a trace, but later, he was named a person of interest in her disappearance. The family's suspicions grew when Josh was found with signs of blunt force trauma, leading to a deeper inquiry into their financial affairs.

Josh's parents, Steve and Susan Powell, were initially listed as beneficiaries on Susan's life insurance policy. When Susan went missing, they filed a claim, but Josh contested it, arguing that he was the primary beneficiary due to their divorce and a prenuptial agreement. The legal battle centered around the interpretation of the agreement and the family's right to the insurance payout.

The case went through multiple court hearings and appeals. Ultimately, a judge ruled in favor of Josh's parents, stating that the prenuptial agreement did not explicitly bar them from receiving the insurance proceeds. This decision allowed them to claim a significant portion of the life insurance money, which had been a subject of intense legal debate.

Yes, the case had broader financial ramifications. Josh's family was also involved in a separate lawsuit regarding the sale of a property, which was a source of potential financial gain. The legal proceedings and the subsequent media attention brought attention to their financial affairs, raising questions about their financial decisions and management.

The media frenzy surrounding the case provided extensive coverage, often focusing on the family's personal lives and financial situations. This attention invaded their privacy and led to public scrutiny. The family's legal team worked to protect their clients' rights and privacy, but the constant media presence made it challenging to maintain a sense of normalcy and privacy during the legal process.