When considering life insurance, understanding the nuances between different policy types is crucial. One key decision point is whether to choose a level or increasing face value policy. Level face value life insurance provides a consistent death benefit throughout the policy term, offering predictable premiums and a fixed payout upon the insured's passing. In contrast, increasing face value life insurance gradually grows the death benefit over time, typically tied to inflation or market growth. This type of policy can be beneficial for those seeking a policy that adapts to changing financial needs. The choice between the two depends on an individual's financial goals, risk tolerance, and long-term financial planning.

| Characteristics | Values |

|---|---|

| Level Face Value Life Insurance | - Provides a fixed death benefit throughout the policy term. - Premiums remain constant over the policy's duration. - Suitable for those who want stable coverage without the need for additional benefits as they age. - Often used for financial planning and long-term savings. |

| Increasing Face Value Life Insurance | - Offers a death benefit that increases annually by a predetermined percentage. - Premiums typically increase as the policyholder ages. - Provides more coverage as the insured person ages, ensuring the policy remains relevant. - Ideal for those who want coverage to keep up with potential wage growth and increased financial responsibilities. |

| Policy Duration | - Level: Typically available for term lengths of 10, 15, 20, or 30 years. - Increasing: Often offered for longer terms, such as 20, 25, or 30 years, sometimes with the option to convert to a permanent policy. |

| Cost | - Level: Generally more affordable in the early years but may become more expensive as the policyholder ages. - Increasing: Premiums start lower but increase over time, reflecting the higher coverage amount. |

| Use Cases | - Level: Common for individuals seeking consistent coverage without the complexity of annual adjustments. - Increasing: Suitable for those with a strong desire for coverage to match income growth or for families with children who may have increasing financial needs. |

| Conversion Options | - Level: Some policies offer the option to convert to a permanent policy (e.g., whole life) later. - Increasing: May provide conversion options, allowing policyholders to switch to a permanent policy with a higher death benefit. |

| Tax Implications | - Both types may be subject to income tax on premiums and death benefits, but the specifics can vary by jurisdiction. |

| Market Trends | - The market is shifting towards offering more flexible and customizable policies, including a combination of level and increasing benefits. |

What You'll Learn

- Cost-Effectiveness: Level face value policies offer consistent premiums, making them budget-friendly

- Long-Term Coverage: Increasing face value policies provide higher coverage over time, ideal for long-term needs

- Financial Goals: Consider your financial goals when choosing between level and increasing face value policies

- Health Changes: Review policy adjustments if health improves or worsens, impacting premium changes

- Flexibility: Increasing face value policies offer flexibility to adapt to changing financial circumstances

Cost-Effectiveness: Level face value policies offer consistent premiums, making them budget-friendly

When considering life insurance, understanding the cost-effectiveness of different policy types is crucial. One approach to ensure long-term financial security is to opt for a level face value life insurance policy. These policies stand out for their consistent and predictable premium structure, which is a significant advantage for those seeking budget-friendly coverage.

In the realm of life insurance, the term "level face value" refers to a policy where the death benefit remains the same throughout the entire duration of the insurance. This means that the amount paid out upon the insured's death is fixed and does not increase over time. As a result, the premiums for these policies are also consistent, providing a stable financial commitment for the policyholder. This predictability is a key factor in the cost-effectiveness of level face value insurance.

For individuals and families, the financial planning aspect is vital. With a level face value policy, you can accurately estimate your insurance costs over the long term. This predictability allows for better financial planning, especially for those on a tight budget. Knowing exactly how much you will pay annually or monthly can help you allocate funds more effectively and avoid unexpected financial strain.

Moreover, the consistent nature of these policies makes them ideal for those who prefer a straightforward and transparent financial arrangement. Unlike increasing face value policies, where premiums rise over time, level face value policies offer a fixed cost, ensuring that your insurance expenses remain stable. This stability is particularly beneficial for long-term financial planning, as it allows you to budget without the worry of increasing costs.

In summary, level face value life insurance policies are an attractive option for those seeking cost-effective coverage. The consistent premiums make it easier to manage finances and provide a sense of security, knowing that your insurance costs will not fluctuate. This type of policy is an excellent choice for individuals and families who prioritize financial predictability and long-term planning.

Life Insurance Options for Diabetics: What You Need to Know

You may want to see also

Long-Term Coverage: Increasing face value policies provide higher coverage over time, ideal for long-term needs

When considering life insurance, understanding the difference between level and increasing face value policies is crucial, especially when planning for long-term financial security. Increasing face value life insurance is a type of policy designed to provide higher coverage as the policyholder ages, making it an excellent choice for long-term needs. This type of policy is particularly beneficial for those who want to ensure that their loved ones are protected financially over an extended period, even as their insurance needs evolve.

The primary advantage of an increasing face value policy is its flexibility and adaptability. As the policyholder ages, their insurance needs typically increase due to various life events, such as starting a family, purchasing a home, or taking on additional financial responsibilities. With an increasing face value policy, the coverage amount automatically rises, ensuring that the policy remains relevant and adequate throughout the policyholder's life. This feature is especially valuable for individuals who want to provide a consistent and growing financial safety net for their dependents.

For instance, imagine a young professional who purchases a life insurance policy with an increasing face value of $500,000. Over time, as they advance in their career, get married, and have children, their insurance needs may grow to $1 million or more. An increasing face value policy would automatically adjust the coverage amount, ensuring that the policy remains aligned with their evolving financial obligations. This level of adaptability is particularly useful for those who want to future-proof their life insurance coverage.

In contrast, level face value policies provide a consistent coverage amount throughout the policy term. While this type of policy is simpler and may be more affordable initially, it may not adequately address the changing financial needs of the policyholder over time. Level policies are best suited for individuals who have a stable income and financial situation that is unlikely to change significantly in the future.

In summary, increasing face value life insurance policies are well-suited for long-term coverage, offering a dynamic and adaptable approach to financial protection. By providing higher coverage over time, these policies ensure that individuals can meet their evolving financial obligations and provide long-term security for their loved ones. When considering life insurance, it is essential to assess your long-term needs and choose a policy that can grow with you, offering peace of mind and financial stability.

Life Insurance: What to Do When Term Expires

You may want to see also

Financial Goals: Consider your financial goals when choosing between level and increasing face value policies

When it comes to life insurance, understanding the difference between level and increasing face value policies is crucial for making an informed decision that aligns with your financial goals. Both types of policies have their unique advantages and considerations, and choosing the right one can significantly impact your financial security and long-term objectives.

Level face value life insurance, as the name suggests, maintains a consistent death benefit throughout the policy term. This means that the payout to your beneficiaries remains the same from the start of the policy until maturity. For example, if you purchase a $100,000 level term life insurance policy for 10 years, your beneficiaries will receive $100,000 in the event of your death during that period. This type of policy is ideal for individuals who want a stable and predictable financial safety net for a specific duration. It provides a fixed amount of coverage, ensuring that your loved ones have a consistent financial resource during the term.

On the other hand, increasing face value life insurance, also known as participating or variable life insurance, offers a death benefit that grows over time. The payout increases by a predetermined percentage annually, providing higher coverage as the policyholder ages. For instance, if you opt for a $100,000 increasing term life insurance policy for 10 years, the death benefit might increase by 5% each year, resulting in a higher payout as you get older. This type of policy is beneficial for those who want to ensure that their insurance coverage keeps pace with their increasing financial needs and responsibilities. As your income and family commitments grow, the increasing face value policy can provide a more substantial financial cushion.

Considering your financial goals is essential when deciding between these two options. If your primary objective is to provide a consistent financial safety net for a specific period, such as covering mortgage payments or funding children's education, a level face value policy might be more suitable. It offers a straightforward and predictable solution, ensuring that your beneficiaries receive the intended amount without any surprises.

However, if your financial goals involve long-term wealth accumulation and you anticipate your financial needs growing over time, an increasing face value policy could be advantageous. This option allows your coverage to adapt to your changing circumstances, providing a higher death benefit as you age and your financial obligations may increase. For instance, if you are planning for retirement and want to ensure that your insurance coverage matches your expected future expenses, an increasing policy can offer peace of mind.

In summary, when choosing between level and increasing face value life insurance, it is essential to align your decision with your financial goals. Level face value policies offer stability and predictability, making them suitable for short-term financial security. In contrast, increasing face value policies cater to long-term goals, providing coverage that grows with your financial needs. By understanding your objectives and the benefits of each policy type, you can make an informed choice that ensures your loved ones are protected and your financial goals are met.

Whole Life Insurance: Interest Rates and Their Impact

You may want to see also

Health Changes: Review policy adjustments if health improves or worsens, impacting premium changes

When considering life insurance, it's crucial to understand the implications of health changes on your policy. Life insurance policies, particularly those with a level or increasing face value, can be adjusted based on your health status, which directly influences the premium rates. Here's a detailed guide on how health changes can impact your insurance policy and what actions to take:

Health Improvements: If your health has significantly improved, it's essential to review your insurance policy regularly. Life insurance companies often monitor policyholders' health to ensure accurate premium calculations. When your health improves, you may be eligible for a premium reduction. This is because a healthier individual poses a lower risk to the insurer, and the reduced risk can lead to lower insurance costs. It's advisable to contact your insurance provider and provide any relevant health updates, such as improved medical test results or a healthier lifestyle. They might offer a policy adjustment, allowing you to benefit from the lower premium rates.

Health Deterioration: Conversely, if your health has worsened, it's crucial to inform your insurance company promptly. Certain health conditions or lifestyle changes can increase your risk profile, leading to higher insurance premiums. For instance, if you've been diagnosed with a chronic illness or have experienced a significant health decline, your insurance provider may request an updated medical assessment. During this review, they will assess the impact of your health changes on the policy's risk level. Depending on the severity of the health issue, the insurer might adjust the premium accordingly, potentially increasing it.

Policy Adjustment Process: When health changes occur, the insurance company will typically review your policy and may require additional medical information. This process ensures that the policy accurately reflects your current health status. It's important to be transparent and provide all necessary details to avoid any potential issues with claims. The insurer might offer a policy adjustment, which could include a temporary or permanent increase in the face value or a change in the policy's terms.

Long-Term Benefits: Regularly reviewing your policy in light of health changes can have long-term advantages. Over time, improved health can lead to significant savings on insurance premiums. Additionally, staying informed about your policy allows you to make necessary adjustments to ensure adequate coverage as your health and life circumstances evolve.

In summary, health changes play a significant role in life insurance policies, especially those with level or increasing face values. Being proactive in reviewing and updating your policy based on health improvements or deterioration can result in better premium rates and overall insurance management. Always consult with your insurance provider to understand the specific implications of health changes on your particular policy.

Life Insurance: Gender-based Pricing and Female Advantage

You may want to see also

Flexibility: Increasing face value policies offer flexibility to adapt to changing financial circumstances

When it comes to life insurance, choosing between a level face value policy and an increasing face value policy can significantly impact your financial security and flexibility. Level face value policies provide a consistent death benefit throughout the term of the policy, ensuring that your beneficiaries receive the same amount in the event of your passing. This predictability can be advantageous for those who have a stable financial situation and want a straightforward insurance plan. However, life is full of uncertainties, and financial circumstances can change over time. This is where increasing face value policies come into play, offering a unique level of flexibility.

Increasing face value life insurance policies are designed to adapt to your evolving financial needs. As the name suggests, the death benefit of this policy increases annually, allowing you to keep up with the rising costs of living and potential financial obligations. For instance, if you take out a policy with an increasing face value, and your family's expenses or financial goals grow over the years, the policy can adjust to provide a higher payout to ensure your loved ones are adequately protected. This feature is particularly beneficial for those who anticipate significant life changes, such as starting a family, purchasing a home, or embarking on a career change.

The flexibility of increasing face value policies is a powerful tool for individuals who want to future-proof their insurance coverage. As your financial situation improves, the policy can match your success by increasing the death benefit, providing enhanced security. Conversely, if your financial circumstances change for the worse, you can opt to reduce the policy's value, ensuring you don't over-insure and potentially save on premiums. This adaptability is a significant advantage, especially for those who prefer a more dynamic approach to insurance planning.

Furthermore, increasing face value policies can be particularly useful for business owners or professionals with fluctuating income. As your earnings grow, so can your insurance coverage, providing a safety net that scales with your success. This type of policy allows you to build a comprehensive financial protection plan that evolves with your career trajectory. By choosing an increasing face value policy, you gain the freedom to adjust your insurance coverage without the hassle of reviewing and potentially adjusting a level face value policy each year.

In summary, increasing face value life insurance policies offer a valuable layer of flexibility to individuals seeking to adapt their insurance coverage to changing financial circumstances. This type of policy ensures that your insurance plan remains relevant and effective as your life evolves, providing a sense of security that can be tailored to your unique needs. Whether you're planning for a growing family, a successful business, or simply want to future-proof your financial protection, considering an increasing face value policy can be a wise decision.

Colonial Penn Life Insurance: Available in Massachusetts?

You may want to see also

Frequently asked questions

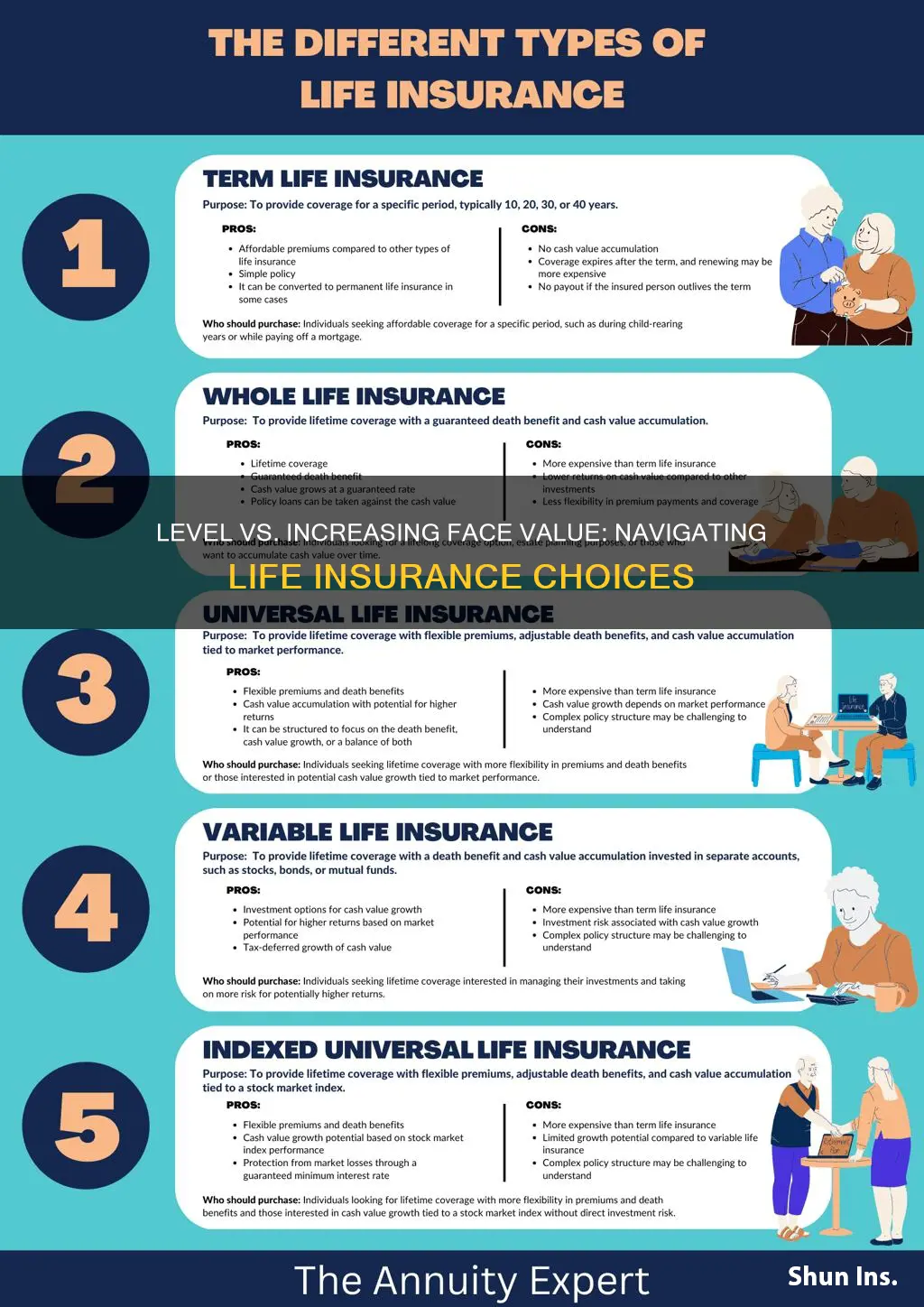

Level term life insurance provides a constant death benefit amount for the entire policy term, ensuring a fixed payout if the insured passes away during that period. On the other hand, increasing face value life insurance, also known as participating or variable life insurance, offers a death benefit that grows over time, often with an investment component.

Level term life insurance is ideal when you need a specific amount of coverage for a defined period, such as when you have a mortgage, dependants, or specific financial goals that require a consistent payout. It provides straightforward coverage without the complexity of investment options.

Increasing face value life insurance can be beneficial if you want a policy that adapts to your changing financial needs. It may offer investment opportunities, allowing your death benefit to grow potentially faster than inflation. This type of insurance can be suitable for those who want a more flexible and potentially rewarding policy.

While increasing face value life insurance can be advantageous, it may also be more complex and expensive. The investment component adds layers of potential risks and fees. Additionally, the policy might not provide a fixed death benefit, and the growth of the policy value is not guaranteed.

The decision depends on your specific financial goals, risk tolerance, and long-term plans. If you prioritize simplicity and a fixed payout, level term life insurance is likely the better choice. However, if you seek potential investment growth and a policy that can adapt to your changing needs, increasing face value life insurance might be more suitable. It's essential to review the policy details and consult with a financial advisor to make an informed decision.